Bookkeeping

What Is A Note Payable? Definition, Nature, Example, And Journal Entries

Content

Accounts payable is always found under current liabilities on your balance sheet, along with other short-term liabilities such as credit card payments. The loan in the amount of $10,000 will be recorded as a debit in notes payable and as a credit to the cash account. The loan amount of $5,000 will be recorded as a debit to notes payable and as a credit to the cash account. Purchasing a building, obtaining a company car, or receiving a loan from a bank are all examples of notes payable. Notes payable can be referred to a short-term liability (lt;1 year) or a long-term liability (1+ year) depending on the loan’s due date. If a company borrows money from its bank, the bank will require the company’s officers to sign a formal loan agreement before the bank provides the money.

Why is ROIC important?

The ROIC ratio gives a sense of how well a company is using the money it has raised externally to generate returns. Comparing a company’s return on invested capital with its weighted average cost of capital (WACC) reveals whether invested capital is being used effectively.

Rather than paying the account off on the due date, the company requests an extension and converts the accounts payable to a note payable. A business may borrow money from a bank, vendor, or individual to finance operations on a temporary or long-term basis or to purchase assets. Note Payable is used to keep track of amounts that are owed as short-term or long- term business loans. Bank loans and bonds are two common types of long-term debt financing. A loan is direct financing from the bank, while bonds are contracts between the debt holder and bondholders for repayment of the bond plus interest. A company normally uses long-term financing for purchases of buildings, equipment and other assets.

Example Of A Note Payable

Notes payable is negotiable instrument issued by the drawer/borrower, containing a promise to pay a specified sum of money at specified terms to the drawee/holder of the instrument. Being a short-term receivable, this note receivable qualifies as a current asset and will be reported as such on the asset side of Mr. Steward’s balance sheet. Notes receivable is a financial instrument that entitles the holder to receive a specified sum of money, from the drawer at terms specified therein. Notes receivable are received by lenders or debtors for amounts due to them. As long-term liabilities, Notes payable help define the company’s degree of leverage and are a component of both the financial structure and the capital structure. Note payable is an accounting term that can refer to any debt that meets the definition above.

The company owes $0 after this payment, which is $10,999 – $10,999. The company owes $10,999 after this payment, which is $21,474 – $10,475.

Notes Payable On A Balance Sheet

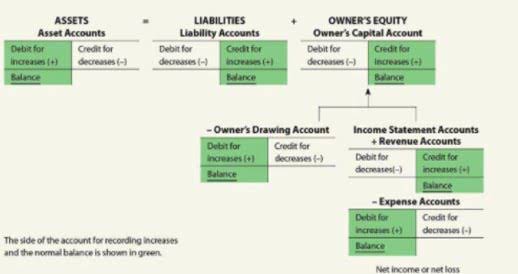

The accounts payable account is mainly used to record the purchasing of goods and services so it has relevance in trees to show the incoming goods and payments to creditors. The double entry for noting accounts payable is that the accounts payable is credited while their respective account is debited.

Once such note is issued and signed by the drawer, it serves as a legally binding undertaking for payment of the amount due at the terms specified therein. This article looks at meanings of and differences between two aspects of promissory notes – notes payable and notes receivable. These are also significant when businesses want to extend the payment period or credit period and hence issue note. It also feature a discount that is the difference between the proceeds of a note payable and its face value and is written in a contra liability account. Notes Payable is a ledger account prepared by an accountant for recording transactions that involve borrowing of money. This is the most effective way of recording the transactions relating to amount borrowed and on which interest is to be paid. The future planning of the business depends on the information provided in notes payable account.

Accountingtools

In simple terms, a note payable is a loan between you and a lender. The cash account is credited, and the balance sheet records it as a liability. Borrowing of money for business needs, mostly short-term, against the issuance of a promissory note, is done through notes payable. In simple words, notes payable is another kind of loan that comes with interest expense.

This is a contra-liability account and is offset against the Notes Payable account on the balance sheet. Notes receivable has a debit balance and is accounted for as an asset which can be a current or non-current asset depending on whether it is a short-term or a long-term note. Metro Inc. requires $50,000 to meet its short-term working capital needs. While Notes Payable refers to a loan, accounts payable refers to the amount of money that a company owes to its vendors and suppliers for goods and services provided. The due date and allowed period are also mentioned on the note payable. The time allowed for payment is an agreed-upon timeline at the will of both parties to contracts. It can be three months, six months, one year, or as the parties consider feasible.

Is notes payable a debt?

Because they are money owed by the company, both short and long-term notes payable are considered liabilities. … While they are both a form of debt capital, only long-term liabilities (and therefore long-term notes payable) are considered a part of a company’s capital structure.

Accounts payable and notes payable are both company debt but fall into separate and distinct categories. Accounts payable in the general ledger hold short-term debt resulting from purchasing goods and services, and they are due to be paid off in 30 days or so. Vendors assume their invoices will be paid, so they do not require any collateral security. As long as their invoices are paid in a timely manner, they will continue to satisfy your new orders. Banks sometimes issue short-term loans or notes to businesses to help with short-term financing needs for equipment and supply purchases. This is common for newer companies that have shown the ability to generate revenue and profit but need more capital for growth and investment.

Accounted By

Instead, the interest expense will be calculated for an exact period until the loan was paid. In the example discussed above, the loan of $20,000 was taken from the bank. Whereas a subsequent liability arising will be recorded on the credit side. The company borrowed $20,000 from a bank due in six months with a 12% interest rate.

Notes payable to banks are formal obligations to banks that an individual or business is required to pay. If you’re looking for accounting software that can help you better track your business expenses and better track notes payable, be sure to check out The Blueprint’s accounting software reviews. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money.

Accounts Payable Vs Notes Payable: The Difference That Saves You Time And Money

Accounts payable might even offer a small discount on the payment if the invoice is paid quicker than usual, like within 10 days instead of the usual 30. Notes payables provide maturity dates for the loan and can extend over months and even years. Notes payable is a formal contract which contains a written promise to repay a loan. Purchasing a company vehicle, a building, or obtaining a loan from a bank for your business are all considered notes payable. Notes payable can be classified as either a short-term liability, if due within a year, or a long-term liability, if the due date is longer than one year from the date the note was issued.

Learn the best ways to calculate, report, and explain NPV, ROI, IRR, Working Capital, Gross Margin, EPS, and 150+ more cash flow metrics and what is notes payable business ratios. Notes payable in more than one year appear under Long-term liabilities, except for any portion payable within a year.

Meet Some Of Our Note Payable Lawyers

In the following example, a company issues a 60-day, 12% interest-bearing note for $1,000 to a bank on January 1. UpCounsel is an interactive online service that makes it faster and easier for businesses to find and hire legal help solely based on their preferences. We are not a law firm, do not provide any legal services, legal advice or “lawyer referral services” and do not provide or participate in any legal representation. As your business grows, you may find yourself in the position of applying for and securing loans for equipment, to purchase a building, or perhaps just to help your business expand.

Many people argue that if account payable is a short-term liability, why can’t the notes payable for less than one year be treated as account payable. It should be understood that a promissory note or note payable is a legal contract and formal agreement between the borrower and lender. Notes Payable is the liability account used to reflect long and short-term debt of a company that was made by the use of promissory notes. When businesses get loans from banks, they will typically show up in the general journal account called Notes Payable. Businesses use money to purchase inventory, equipment, land, buildings, or many other things to help them to expand or become more profitable. When businesses need to borrow money, they may go to a bank and sign a promissory note. A promissory note is a written agreement from the business to borrow money for a certain amount of time and interest rate.

This blog will help you understand what notes payables are, who signs the notes, examples, and accounting treatment for the company’s notes payable. On the maturity date, both the Note Payable and Interest Expense accounts are debited.

- The items purchased and booked under accounts payable are typically those that are needed regularly to fulfill normal business operations, such as inventory and utilities.

- There are other instances when notes payable or a promissory note can be issued, depending on the type of business you have.

- A written agreement between two parties stating that one will pay the other back at a later date.

- Finally, with the interest determined, you can enter the amount on your balance sheet as a debit in interest payable, and as a credit to the cash account.

- We are not a law firm, do not provide any legal services, legal advice or “lawyer referral services” and do not provide or participate in any legal representation.

- There is always interest on notes payable, which needs to be recorded separately.

Notes Payable can either be categorized as current or non-current accounts depending how the length of the loan. For example, a short-term loan to purchase additional inventory in preparation for the holiday season would be classified as a current liability, because it will likely be paid off within one year. The purchase of land, buildings, or large equipment will commonly be categorized as non-current liabilities, because the long-term loans will be paid over the course of many years.

- Businesses use money to purchase inventory, equipment, land, buildings, or many other things to help them to expand or become more profitable.

- Try it nowIt only takes a few minutes to setup and you can cancel any time.

- Costs go down, profits go up, and the liquid funds to settle the note when it becomes due can be planned for.

- CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle.

- Free AccessFinancial Metrics ProKnow for certain you are using the right metrics in the right way.

He is the sole author of all the materials on AccountingCoach.com.

Lithium Americas Closes Over-Allotment on Convertible Senior Notes Offering – Yahoo Finance

Lithium Americas Closes Over-Allotment on Convertible Senior Notes Offering.

Posted: Thu, 09 Dec 2021 21:30:00 GMT [source]

Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. Notice how notes payable can be short-term or long-term in nature. The proper classification of a note payable is of interest from an analyst’s perspective, to see if notes are coming due in the near future; this could indicate an impending liquidity problem. Notes Payablein Schedules “A” & “C”, on the respective balance sheets of the corporations. Subsequent to 1/1/97, Bob Ramsey has drawn the 48 equity out of Southwest General Services, Inc.